As the adoption of 5G continues to accelerate, the demand for mobile data capacity does not appear to be slowing down anytime soon. In an effort to keep up, the Federal Communications Commission (FCC) has continued to make new radio frequency (RF) spectrum available. Yet, the profusion of various spectrum bands licensed for 5G can be particularly complex, creating more confusion than clarity.

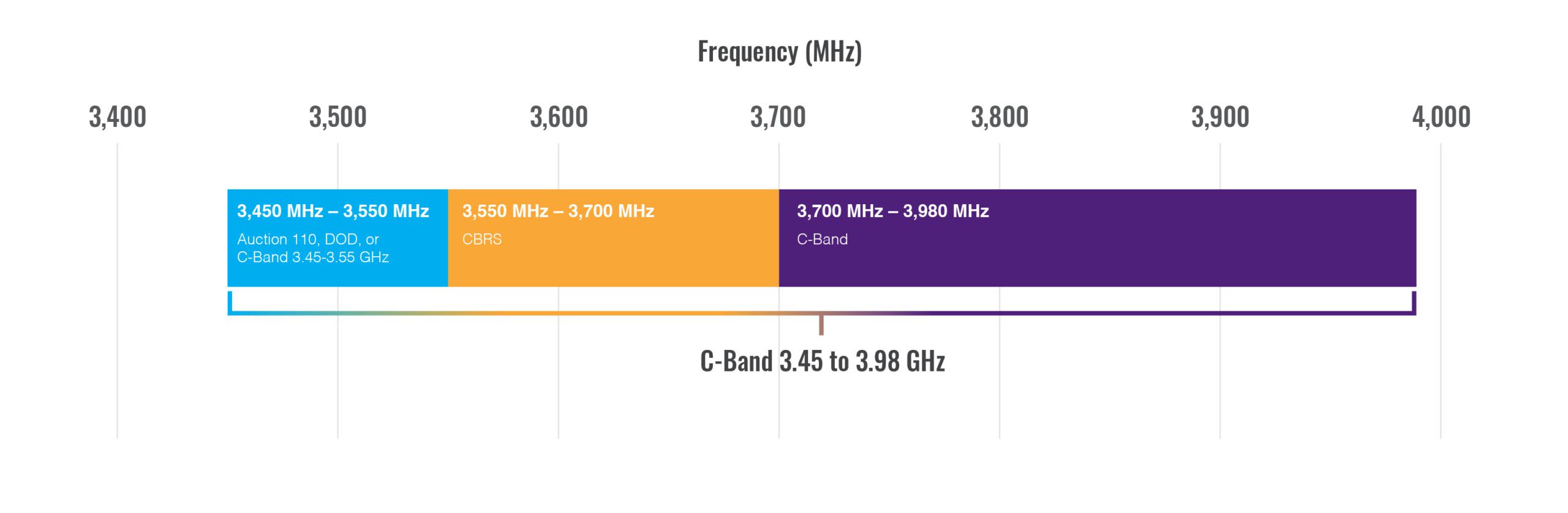

The bands that the FCC has made available for 5G most recently tend to be frequencies in the mid-band, including the C-Band, Auction 110, and the Citizens Broadband Radio Service (CBRS). Mid-band spectrum offers an optimal mix of speed, capacity, and coverage to enable improved 5G subscriber service. But not all mid-band spectrum is the same.

The C-Band

The FCC previously reserved the C-Band for satellite TV transmissions before advanced digital encoding methods enabled satellite companies to “repack” their broadcasts into the upper portion of the band. In 2020, the FCC auctioned off 280 MHz of the lower portion of the C-Band spectrum between 3.7 – 3.98 GHz for 5G networks. Finalizing the release of the C-Band spectrum took several years to resolve, including intense negotiations with the Federal Aviation Administration (FAA) over concerns about interference with airplane radar altimeters.

Once the Tier 1 mobile network operators (MNOs) could switch on 5G networks in the C-Band, they quickly began transforming subscribers’ 5G experience with increased bandwidth and faster speeds. That’s because the C-Band contains enough spectrum to support larger 5G channels (up to 5x larger than typical 4G channels). At the same time, the frequency is still low enough for good signal propagation — as opposed to higher frequencies, such as the mmWave bands, that have very short transmission distances.

Auction 110

The Auction 110 band, also known as either Andromeda or Lower n77, occupies the mid-band RF spectrum between 3.45 – 3.55 GHz. The two largest Auction 110 license holders are AT&T and DISH Network, followed by T-Mobile, US Cellular, and several private equity companies. Like C-Band, the MNOs plan to deploy the Auction 110 spectrum rapidly. Because of the proximity of these two bands, similar infrastructure, including antennas and radios, may support both bands and enable MNOs to combine deployment efforts to reduce costs. Some MNOs delayed some of their C-Band deployments waiting for the new spectrum to become available. FCC rules for the Auction 110 spectrum limited ownership to 40 MHz. While these spectrum segments do not support the largest 5G channels alone, they may be aggregated with spectrum in other bands to produce similarly improved performance.

CBRS Band

CBRS Band

Three tiers of users share the CBRS spectrum, which occupies 150 MHz between 3.55 – 3.7 GHz, and each tier has a different level of priority. The first tier consists of incumbent users using the CBRS band for mission-critical situations, such as the US military and satellite ground stations. Next are the priority access license (PAL) holders, including telecom carriers, internet service providers, and large enterprises who received licenses in the 2020 auction. Each license provides 10 MHz, and each PAL licensee could obtain up to four licenses in an area.

The remaining tier of CBRS users have access to general authorized access (GAA) channels. These channels are essentially the same as the unlicensed Wi-Fi spectrum, which anyone can use freely as long as they do not interfere with traffic on the first two tiers. While the CBRS license size limits the usefulness of the spectrum for 5G service, which requires larger channels for spectral efficiency, it still plays an important role in building private networks for industrial and enterprise applications. In addition, MNOs may aggregate channels deployed in the CBRS band with channels in other bands to augment network capacity.

Finding Middle Ground

For today’s MNO making huge investments in 5G, spectrum is precious, and more spectrum is better. With broad, dedicated channels and a decent signal range, the C-Band is an ideal spectrum choice for 5G service providers, offering greater capacity for plenty of mobile bandwidth to increase overall 5G access. However, the FCC is making C-Band available in two phases as they clear the spectrum, which means that timeframes will vary considerably as portions of the band become available in different markets.

On the other hand, Auction 110 and CBRS are both available now. Nonetheless, the use of CBRS for 5G networks has been limited. CBRS is well-suited for augmenting capacity and building out private networks. However, the C-Band and Auction 110 frequencies are more desirable for 5G because they provide dedicated bandwidth, larger channels for reliable and efficient spectrum use, and a longer timeframe to achieve a return on investment (ROI).

Mid-Band 5G

With 280 MHz of bandwidth, the C-Band delivers the speed and capacity to enable Enhanced Mobile Broadband (eMBB) use cases for 5G. In fact, the abundance of its available spectrum and its propagation characteristics heighten performance in indoor and enterprise situations that go beyond data communications services. C-Band takes advantage of cutting-edge cellular technologies, such as carrier aggregation and massive MIMO antennas, to enhance service quality and pave the way for new applications and connectivity services.

However, the C-Band spectrum offers just one-fourth of the signal propagation characteristics of legacy mobile communications bands because it spans higher frequencies. As a result, achieving the same indoor coverage footprint with C-Band will require a higher effective output power from the antenna. That’s why the SOLiD ALLIANCE 5G DAS platform provides a modular high-output power C-Band remote and a lower-power fiber-to-the-edge (edgeROU) solution for overlay applications. These options enable various approaches to add support for C-Band 5G to your in-building coverage infrastructure.

Enhanced 4G LTE

CBRS also enables MNOs to deploy 5G without investing in spectrum licenses, but the channels in this spectrum are not universally accessible by all network operators. Plus, a limitation on transmitted power restricts its useful range for mobile applications, making CBRS more suitable for small coverage areas. This mid-band spectrum is better suited to add capacity within the 4G network and to help bridge the shortcomings of Wi-Fi. Deploying a private LTE network with CBRS addresses insufficient coverage and network congestion issues typical with Wi-Fi to facilitate more efficient enterprise workflows.

Moreover, CBRS offers the opportunity to provide privacy and secure access to private enterprise LTE networks. This allows the enterprise to ensure that sensitive business data remains within the confines of a corporate network with login requirements and SIM cards to restrict access and avert potential hacking. This type of private network built on the CBRS spectrum is well-suited to sectors such as healthcare and financial services requiring high security levels.

Expanding IoT Opportunities

As the internet of things (IoT) begins to transform the digital economy, applications supporting GPS navigation, utility meters, smart assistants, and health trackers are becoming more prevalent and changing how we live. 5G mobile services play an important role in the growth of this market.

The C-Band and Auction 110 spectrum easily support IoT, offering the capacity and coverage needed to deliver high-quality IoT services. Service providers can control capacity with this licensed spectrum to provide guaranteed service levels for IoT in critical-use situations, such as those in security and medical applications.

PAL network operators also can use CBRS for some specialized IoT applications. Private LTE networks maintain connectivity among IoT devices for a range of industrial, agricultural, and enterprise applications. For example, CBRS-based private networks can increase farm yield by using sensors on agricultural equipment to monitor repairs and environmental conditions.

Seamless Connectivity

Each of these mid-band spectrum options offer unique capabilities to enhance coverage and bandwidth for better mobile experiences. Ensure that your in-building DAS platform is ready to deliver optimized voice and data service with support for the C-Band, Auction 110, and CBRS, reducing connectivity issues such as dropped calls and intermittent signals in business, residential, and public spaces.

The SOLiD ALLIANCE 5G DAS provides fully occupied mid-band coverage, including 2×2 MIMO for all 380 MHz of licensed C-Band and Auction 110 spectrum from day one, with multiple output power options to meet the unique needs of your venue. To learn more, visit: www.solid.com/us/resources.