Why DAS as a Service is the Right Investment Right Now

Today’s global economy runs on connectivity. Indeed, Internet access is now considered to be an essential utility, with billions of dollars being spent on broadband access. In the U.S., government infrastructure programs such as the Internet For All Initiative are doling out huge grants to ensure equal Internet access for everyone.

Today’s global economy runs on connectivity. Indeed, Internet access is now considered to be an essential utility, with billions of dollars being spent on broadband access. In the U.S., government infrastructure programs such as the Internet For All Initiative are doling out huge grants to ensure equal Internet access for everyone.

As demand for always-on digital voice and data access continues to skyrocket, high-quality mobile service is increasingly important to consumers and businesses alike. That demand is largely indoors, where more than 80 percent of all mobile voice and data traffic occurs. This in-building connectivity need is only escalating due to the demand for 5G mobile service, Industry 4.0 private networks, and Internet of Things (IoT) connectivity.

Yet, many modern building materials block radio frequency (RF) signals, restricting indoor mobile communications and leading to poor service and dropped calls. Therefore, to deliver seamless connectivity throughout commercial buildings, enterprise offices, high-rise apartments, and university campuses, building owners and network operators frequently install fiber-to-the-edge distributed antenna system (DAS) technology. In fact, the global DAS market is expected to maintain an annual growth rate of more than 6 percent to reach a value of $13 billion by 2028.

Funding DAS

Without reliable in-building mobile connectivity, many businesses are at a competitive disadvantage. Yet, the average enterprise or commercial building tenant may not be willing or able to invest in DAS equipment deployment to provide dedicated capacity for their employees and customers. This market need has given rise to DAS Network as a Service (NaaS) — a new trend in digital infrastructure investments.

System integrators and third-party network operators deploy DAS platforms in commercial buildings and venues, providing network connectivity to building owners and tenants. The network operator assumes the risk of purchasing, deploying, and operating the DAS equipment, delivering maximum coverage and capacity quickly and efficiently throughout the building or campus. With a DAS NaaS offering, building owners have an affordable, pay-as-you-go method to quickly solve poor in-building mobile coverage and maximize commercial real estate value with minimal upfront investment.

With the popularity of this NaaS offering, the DAS as a Service (DaaS) trend is quickly disrupting the in-building connectivity landscape. That’s why a growing number of digital infrastructure investors are investing in the DaaS market, seeking a safe haven to maximize their infrastructure investments.

Boost Return on Investment

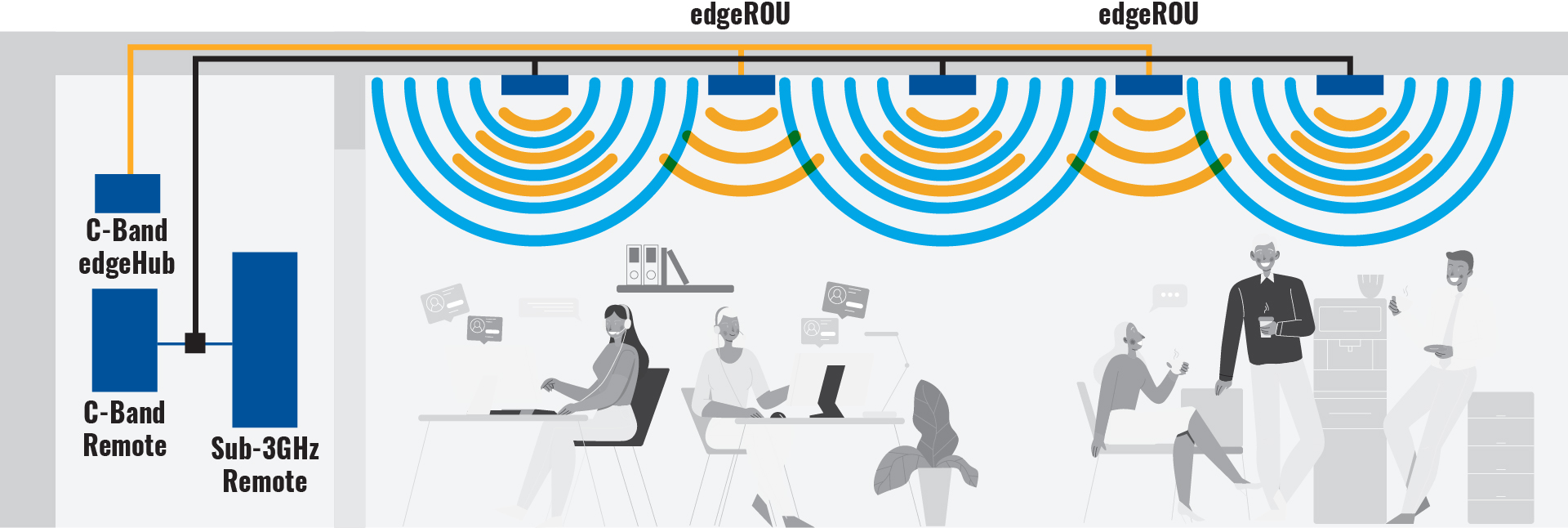

Poor mobile connectivity is no longer acceptable in today’s economy. To ensure the reliable delivery of seamless in-building 5G service, a number of leading DaaS service providers, including Strategic Venue Partners (SVP), RF Connect, and CTS are deploying the SOLiD ALLIANCE 5G DAS solution. The SOLiD ALLIANCE edgeROU FIBER2ANTENNA technology offers maximum coverage, capacity, and speed in a small, energy-efficient, aesthetically pleasing platform, improving productivity, ensuring customer satisfaction, and increasing property values.

Rob Cerbone, VP of Product Management and Marketing at managed service provider Communication Technology Services (CTS), said, “We’ve definitely seen more market demand for NaaS. The advantages of NaaS for building owners who need to provide high-quality in-building connectivity include staff optimization, preservation of capital, and the assurance of future-technology service. Most of all, NaaS allows companies to focus on their core business.”

“Increasingly, we recommend DAS as a Service to customers because it empowers them to forego the upfront capital expenditure of a DAS and, instead, reallocate that capital for other uses or investments. Equally compelling, the DAS as a Service model guarantees technology refreshes and band addition upgrades over the term, which ensures connectivity requirements are met across what we at RF Connect refer to as the 'Now, Near, and Far' timeframe,” explained Josh Gerst, VP of Engineering at RF Connect.

“Strategic Venue Partners is transforming wireless connectivity by bridging the gap between enterprise venues and carriers, paving the path for the world's most vital industries to grow and adapt with the evolving demands on their digital infrastructure. We partner with venues and carriers to design, develop, install, own, operate and upgrade bespoke in-building wireless systems, utilizing the latest technologies such as the SOLiD ALLIANCE edgeROU FIBER2ANTENNA and more,” noted Justin Marron, CEO of Strategic Venue Partners (SVP). “SVP’s unique and long-term approach to delivering critical infrastructure reduces the connectivity and financial burden for enterprise businesses by meeting their existing needs while planning for future technological changes and developments through a utility-based model that benefits everyone.”

With NaaS powered by the SOLiD ALLIANCE DAS edgeROU solution, commercial building owners are providing tenants with the in-building 5G coverage they crave, with no upfront investment and minimal risk. And savvy digital infrastructure investors and financial firms have an ideal opportunity to maximize their return on investment in this emergent market. To learn more about in-building mobile coverage, DAS, and NaaS, please visit our video library at https://solid.com/us/resources/multimedia/videos.

Why TAA Compliance Matters in Telecom

As cyber threats continue to grow worldwide, the origin of goods and materials becomes ever more important. This is particularly crucial in the telecommunications industry, where cyber-attacks or state-sponsored espionage can have devastating consequences.

For example, national security concerns prompted the Federal Communications Commission (FCC) to pass the Secure and Trusted Communications Networks Act of 2019, which explicitly bans the use of telecom equipment manufactured by certain Chinese companies. These concerns are so critical that the U.S. government is spending billions of dollars to replace legacy network equipment from China in existing networks.

However, the movement to regulate the country of origin for imported goods and materials dates back well before 2019. The Trade Agreements Act (TAA) was originally established in 1979 to bolster America’s involvement in the international trade market. This statute established certain rules to regulate the market, including a requirement of TAA compliance to qualify for Federal contracts administered by the General Services Administration (GSA).

What is TAA Compliance?

According to the TAA, all products listed on a GSA schedule or other government contract must be wholly manufactured or "substantially transformed" in either the U.S. or a TAA-designated country. In other words, those goods that are not made in America need to originate in specifically designated countries or be transformed into a 'new and distinctly different' article of commerce. Countries that are not TAA-compliant include China, India, Iran, Iraq, and Russia, among others.

Like the Secure and Trusted Communications Networks Act, compliance with the Trade Agreements Act plays an important role in safeguarding the federal supply chain, and the U.S. government has made TAA compliance enforcement a priority. That’s why violating the TAA or making false claims can be a costly mistake, resulting in multimillion-dollar fines and exclusion from future federal contracts.

Made in America…?

The truth of the matter is that no distributed antenna system (DAS) equipment is wholly manufactured in the U.S. However, it still matters where in-building DAS components are produced. SOLiD is a global company headquartered in South Korea, and we are committed to delivering secure products that comply with statutory and regulatory requirements.

We manufacture all SOLiD ALLIANCE head-ends and edgeROU remote units in our South Korea facility, and we have the capability to manufacture our 2W, 5W, and 20W remotes in South Korea as well if needed. SOLiD has manufacturing facilities in South Korea (TAA designated) and Vietnam (non-TAA designated). Moreover, our Assembly, Configuration, and Test procedures (ACT) are implemented in the U.S. to provide industry-leading reliability and convenience, and achieve sustainability goals by reducing shipping and packaging waste.

At SOLiD, we are dedicated to offering innovative, reliable DAS solutions that comply with TAA requirements to meet the in-building mobile coverage needs of the world’s best-known and most challenging venues. To learn more about TAA-compliant DAS solutions or to discuss your project’s requirements, contact us: solid.com/us/contact.

SOLiD Appoints Scott Deweese as President of SOLiD Americas

SOLiD, the leader in cellular in-building mobile coverage, has named Scott Deweese President of SOLiD Americas. In this position, Scott will be responsible for executive leadership and guidance, and oversee technology and product development for SOLiD’s industry-leading connectivity solutions including distributed antenna system (DAS) platforms and Open RAN radio units (O-RUs).

SOLiD, the leader in cellular in-building mobile coverage, has named Scott Deweese President of SOLiD Americas. In this position, Scott will be responsible for executive leadership and guidance, and oversee technology and product development for SOLiD’s industry-leading connectivity solutions including distributed antenna system (DAS) platforms and Open RAN radio units (O-RUs).

Scott brings SOLiD over 20 years of business development, sales, operations, and executive management experience in the wireless industry. Since joining SOLiD in 2016, Scott has served as General Manager, Sr. Vice President of Sales, responsible for Sales and Business Development, and Sr. Vice President of Operations, responsible for all post-sales operations across the Americas.

"We are pleased to appoint Scott Deweese as President of SOLiD Americas," said Seung Hee Lee, Ph.D., Vice Chairman and Global CEO, SOLiD, Inc. "Scott has earned the respect and admiration of our entire organization with his successful guidance of sales and operations across the Americas.”

What’s on the Horizon for Connectivity Technology?

Since the introduction of mobile networks, wireless communications technology continues to evolve. And if it seems to be advancing more quickly than ever before, that’s not an illusion – the adoption of 5G technology is growing faster than any previous mobile technology generation.

But this relentless evolution doesn’t happen in a vacuum; it creates ripple effects across the telecommunications landscape, impacting network technology in many ways. So, with that in mind, what other trends can we expect to see in 2024 and beyond?

Going Private

The rapid rise of 5G is largely due to a range of benefits this technology brings, including ultra-low latency, faster data speeds, and high reliability. Not surprisingly, many enterprises, universities, and manufacturers find that these advantages also make 5G ideal for private networks, particularly when using unlicensed spectrum such as Citizens Broadband Radio Service (CBRS) frequency bands throughout buildings and across campuses.

Private 5G network deployment provides dedicated bandwidth, scalable capacity, and reliable security that delivers seamless connectivity for mobile and IoT-enabled devices, as well as mission-critical industrial use cases, improving both productivity and profitability. In fact, with high accuracy and low latency, private 5G networks empower innovative, data-driven Industry 4.0 edge applications such as manufacturing automation, occupational health and safety, real-time indoor/ outdoor positioning intelligence, smart asset tracking, and predictive maintenance. As a result, we can expect to see continued adoption of private 5G networks across a wide range of industries.

Open to Opportunity

For many mobile network operators (MNOs), the key to realizing the true promise of 5G is the continued disaggregation of network architecture with the adoption of Open RAN. That’s because MNOs can reduce costs, improve performance, and speed service delivery with open, multi-vendor networks that are compliant with interoperability standards like the O-RAN ALLIANCE specifications, as opposed to being locked in a single or dual-vendor approach.

As the mobile industry continues to embrace an open ecosystem for wide-area networks, Open RAN technology also impacts the evolution of network architecture for in-building networks, driving the need for greater interoperability among distributed antenna systems (DAS) components. For example, interoperability between Open RAN technology and a neutral host DAS RF interface unit enables network operators, neutral hosts, and system integrators to reduce space and power requirements for faster, simpler in-building coverage deployments to create a truly seamless 5G experience everywhere.

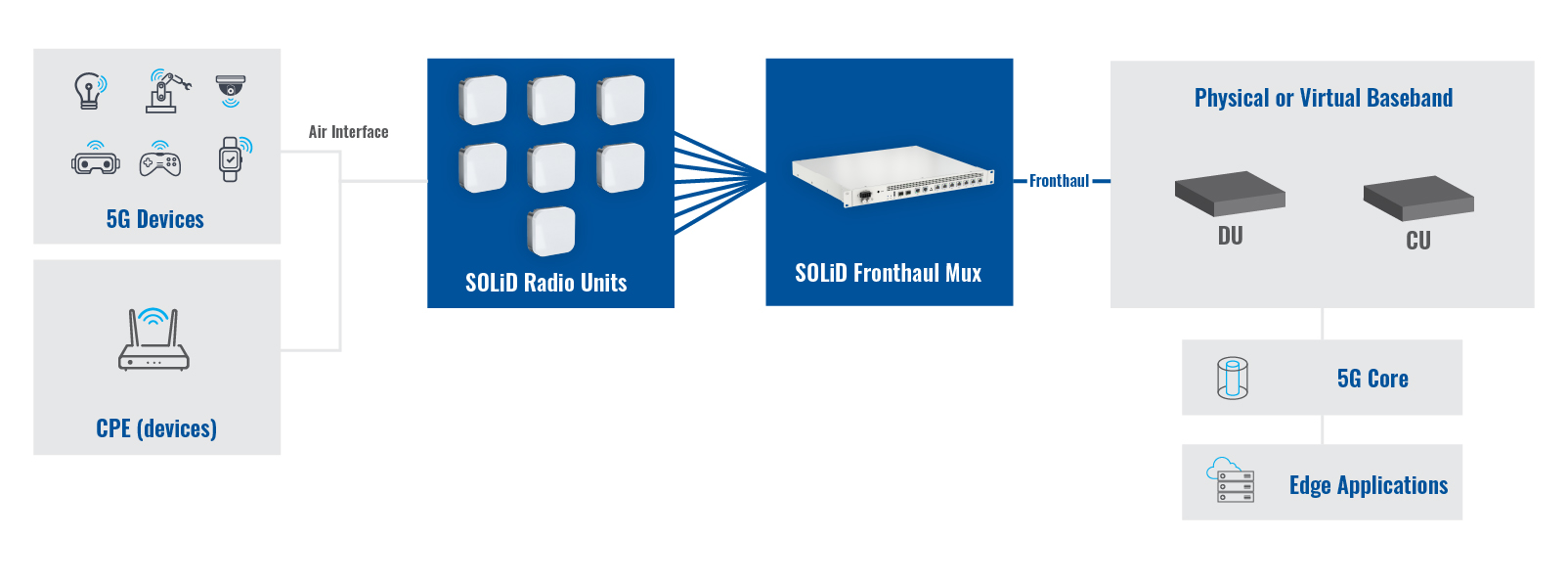

Moreover, the anticipated surge in private 5G networks will continue to drive innovative advancements, such as the SOLiD CBRS O-RAN Radio Unit (O-RU) designed to improve service agility, scalability, and efficiency of private 5G networks. With support for 4G LTE and 5G New Radio (NR) in standalone (SA) or non-standalone (NSA) architecture, this O-RU is compatible with various virtual or physical baseband products via an eCPRI interface.

Likewise, the evolution to more open, multi-vendor networks is creating a desire to further reduce costs and improve efficiencies. Technology like the SOLiD Fronthaul Multiplexer (MUX) eliminates the need for dedicated bandwidth for each radio unit, enabling more economical use of spectrum.

RAN Sharing Revolution

The desire for more efficient use of spectrum also is contributing to a growing interest in active RAN sharing, which helps MNOs reduce costs and avoid potential problems caused by over-building their networks. This shared infrastructure approach offers a number of benefits, from improved cost efficiencies to reduced environmental impacts, and various configuration options range from minimum to maximum sharing.

With a multi-operator RAN (MORAN), multiple MNOs share radios, antennas, towers, and power, while retaining dedicated baseband units (BBUs). The MORAN configuration allows full visibility and control of BBU equipment but requires changes to fronthaul switches to enable multiple interfaces. A ‘shared O-RU’ feature is a cost-effective option when implementing O-RAN networks.

Alternatively, with a multi-operator core network (MOCN) architecture, multiple MNOs share one or more CBRS channels to achieve maximum RAN sharing and cost efficiency. This configuration allows MNOs to pool spectrum allocations for greater resource efficiency, although it affords limited visibility of the RAN. As MNOs face ever-greater cost pressures, active RAN sharing is expected to grow in popularity, and we anticipate that both MORAN and MOCN will be implemented.

Service on Demand

An emerging trend across many different network technologies is the rise of Network as a Service (NaaS) offerings, due to the appeal of reduced capital expenditures (CapEx), faster service provision, and simplified management. Likewise, for some commercial building owners and enterprises, the best option to quickly obtain pervasive in-building coverage may be with a neutral-host DAS as a NaaS offering.

This DAS NaaS option, such as the service provided by SOLiD’s partner Tillman Digital Cities, takes the guesswork out of in-building connectivity with an end-to-end turnkey system. As the owner and operator of the in-building DAS infrastructure, TDC finances, operates, manages, and maintains the network powered by the SOLiD ALLIANCE 5G fiber-to-the-edge DAS, delivering maximum bandwidth and low power consumption in an unobtrusive design.

Tomorrow and Beyond

As future mobile networks evolve to progressively more open, shared architectures, these network changes will transform how in-building DAS equipment operates. SOLiD has been at the forefront of connectivity technology innovation for 25 years, and we will continue to deliver the most efficient, sustainable, cutting-edge technologies for always-on, in-building connectivity. To learn more, visit: https://solid.com/us/open-ran.

How Poor Connectivity Impacts Patient Outcomes

Originally posted on healthcareittoday.com

When delivering first-rate care, every aspect of the patient experience is critical. And in today’s always-connected 5G world, much of that experience depends on pervasive, secure mobile device connectivity. Physicians, nurses, staff, patients, and visitors need seamless indoor wireless coverage.

As a result, the health of a hospital’s in-building wireless network is more important than ever — from the patient intake process to the delivery of accurate medical device results to secure transmission of electronic health records. So, what can healthcare IT professionals do to ensure a better-connected experience for patients, staff, and visitors?

Mobile Connectivity Matters

Spotty or nonexistent In-building mobile connectivity impacts the patient experience significantly. Consider if a patient is trying to use their smartphone to review laboratory test results or a family member wants to video chat with other family members about a loved one’s care. Moreover, many healthcare facilities now allow a bring-your-own-device (BYOD) policy, which means that physicians and staff must have secure and reliable 24×7 connectivity to the major mobile network providers to access electronic healthcare records and application data or to consult with a distant specialist about a patient’s treatment.

Now, consider cutting-edge technology use cases that are still on the horizon. Future healthcare technology might include remote surgery enabled by augmented reality (AR) and virtual reality (VR) or the use of complex artificial intelligence (AI) and machine learning (ML) algorithms to conduct patient diagnoses. Tomorrow’s healthcare providers will use the Internet of Things (IoT) to monitor and maintain diagnostic equipment and other medical devices. These applications require mission-critical, secure, reliable, and ubiquitous connectivity to ensure optimum patient outcomes.

Technology Evolution Concerns

The inconvenient truth is that hospitals and medical campuses are not built with mobile signal transmissions in mind. Neighboring structures, modern LEED building materials, energy-efficient windows, and unique interior layouts present physical challenges to device connectivity indoors. Compounding this situation is the nearly pervasive adoption of 5G technology, which is rapidly changing how we stay connected. In fact, the number of 5G subscribers is predicted to reach 8 billion worldwide by 2028, up from approximately 1.4 billion already.

As demand for 5G continues to grow, the need for greater network coverage and capacity requires new 5G radio frequency (RF) spectrum allocations. In response, the U.S. Federal Communications Commission (FCC) opened up new mid-band frequencies, such as the C-Band and Citizens Broadband Radio Service (CBRS), to supplement the higher mmWave frequencies already allocated for 5G.

Unfortunately, although these new mid-band frequencies offer an ideal mix of speed, capacity, and coverage for outdoor wide-area 5G networks, their signal characteristics are not necessarily ideal for in-building connectivity. In fact, the mid-band and higher spectrum 5G frequencies in use today are even less likely to penetrate building materials than the lower frequencies traditionally used for mobile communications. This means that signals from outdoor networks are blocked not only by neighboring buildings but also by interior walls, furniture, and other obstacles, leading to dropped calls and poor quality of service (QoS) inside buildings.

Plan for Today and Tomorrow

To ensure that patients, staff, and visitors can access 5G communications inside buildings and across campuses, existing in-building distributed antenna system (DAS) platforms must be updated or replaced to work with the new mid-band frequencies. If the DAS platform cannot be upgraded, this might require an expensive and time-consuming “rip and replace” project. On the other hand, those healthcare facilities with a modular, multi-band DAS may be able to add new frequency bands to their existing equipment. However, there will be some necessary modifications due to the particular characteristics of the new frequency bands.

Mid-band spectrum is well-suited for 5G wide-area network deployments because it provides access to larger channels compared to older technologies, which enables significantly greater capacity. Yet, wider channels consume more radio output power, resulting in a smaller coverage area per antenna due to weaker signals. This is compounded by the fact that the mid-band spectrum also offers a shorter signal propagation range than the previous mobile communications spectrum.

Moreover, interior building materials such as walls, cubicles, and furniture will further impede penetration of 5G frequencies throughout the building. For example, indoor C-Band coverage per antenna is roughly 15 percent of the coverage provided by legacy mobile frequencies at the same power level. In fact, in a typical building with furniture and sheetrock walls, an antenna providing a little more than 1,000 square feet of coverage with 4G in the legacy Advanced Wireless Service (AWS) band would only cover around 150 square feet with the 5G C-Band.

As a result of all these obstacles, achieving the same in-building coverage footprint will require changes in how the upgraded DAS equipment is configured. This might mean the addition of amplifiers that provide 4 to 10 times more output power per antenna to prevent “dead zones” where coverage drops off. Alternatively, if the legacy system already uses high-output power amplifiers, adding a fiber-to-the-edge overlay system to support the new 5G frequencies is another option. This allows high-speed data and voice transmissions to be carried all the way to the edge of the network, closer to the users, for enhanced connectivity and improved QoS.

With a common fiber infrastructure throughout buildings and across campuses, healthcare IT professionals can take advantage of the latest optical networking capabilities for wired local area networks (LANs). This fiber infrastructure provides optimized performance, minimum latency, and inherent data security to support IoT connectivity, AR/VR technologies, and new medical devices that require higher bandwidth. In addition, a fiber LAN enables more efficient building management systems, such as intelligent heating and lighting, or secure personnel access systems.

Improve Overall Experiences

Today’s patient experience is dynamically changing. Smartphones, tablets, laptops, and mission-critical medical devices need to work all the time, everywhere, throughout healthcare facilities. As the Tier 1 mobile service providers continue building their networks using mid-band 5G frequencies, in-building communications systems must evolve to keep pace. This evolution enables healthcare facilities to deliver a more pervasive, secure connectivity experience that facilitates BYOD mobility and provides sufficient bandwidth for the best possible patient experience and overall well-being.

How a More Sustainable DAS Speeds the Race to Net-Zero

Sustainability has become an urgent focus for many enterprises, governments, and communities worldwide. Yet as connectivity demands escalate, overall communications network electricity usage continues to rise. This means it is increasingly difficult for network operators to achieve sustainability goals and building owners to meet and building emissions compliance requirements on the road to achieving Net-Zero emissions.

Sustainability has become an urgent focus for many enterprises, governments, and communities worldwide. Yet as connectivity demands escalate, overall communications network electricity usage continues to rise. This means it is increasingly difficult for network operators to achieve sustainability goals and building owners to meet and building emissions compliance requirements on the road to achieving Net-Zero emissions.

At SOLiD, this emphasis on sustainability is nothing new. In fact, we have a history of offering reliable, sustainable solutions that contribute to a greener planet in several ways.

On Track to Sustainability

SOLiD sustainability begins with engineering excellence, resulting in DAS solutions designed to deliver the highest performance with the lowest carbon footprint. For example, the ALLIANCE edgeROU DAS platform supports the fully-occupied 280 MHz of the C-Band while consuming a maximum of 35 watts — just one-third the amount of energy required for alternative fiber-to-the-edge DAS remotes, despite providing a much higher RF output power.

Each edgeROU remote supports the entire bandwidth of up to four frequency bands, allowing each remote unit to accommodate more spectrum, frequency bands, and services from the public cellular networks. This means that in-building network managers need fewer SOLiD DAS remotes to achieve the same coverage and capacity as competing solutions. Plus, the ALLIANCE edgeROU is the smallest active DAS remote available.

As a result, with each remote consuming less energy, being smaller, lighter in weight, and with fewer remotes needed overall for seamless coverage, far fewer resources are consumed in manufacturing, shipping, and operating the ALLIANCE edgeROU platform. This makes it the industry’s “greenest” active DAS solution and the most affordable with a low total cost of ownership (TCO). Likewise, our SOLiD ALLIANCE high-power remote optic unit (HROU) solutions, such as the Mid-Band HROU_4000, include a power-saving function, allowing them to reduce power when traffic demand is low.

Modular Momentum

In addition to reducing resource consumption, there is another important aspect to the SOLiD sustainability track record as well. Because the SOLiD ALLIANCE platform is modular, network operators and building owners can easily replace, reuse, and upgrade individual components as needed to keep up with evolving telecom technologies, such as today’s 5G and tomorrow’s 6G mobile networks. This eliminates the significant time, expense, and waste generated by a rip-and-replace project to swap out an entire non-modular DAS system.

Moreover, the modularity of SOLiD DAS equipment allows us to ship all the system components to one place, where we assemble the head-ends before delivering the assembled system to our customer’s site. This enables us to recycle the component packaging rather than leaving that responsibility to network operators or system integrators who may not have ready access to recycling facilities.

Sustainable Innovation

For our society to achieve needed Net-Zero goals, we all have to do our part, including network operators, building owners, system integrators, and suppliers. Sustainable network solutions and practices provide powerful tools to aid the decarbonization of the worldwide economy — reducing the network’s carbon footprint and helping businesses make better choices to build a more sustainable model for the future.

For 25 years, SOLiD has continuously innovated to deliver best-in-class solutions for a globally complex, ever-evolving telecommunications industry. As rising connectivity demands drive the need for greater global sustainability, we will continue to innovate to deliver the most reliable, sustainable, and high-performance connectivity solutions on the market. To learn more, visit: solid.com/us/products/alliance-das.

SOLiD Ramps Up O-RAN Business

October 4, 2023 – Today, SOLiD joined as a new radio unit (RU) partner for OREX®, NTT DOCOMO's global Open RAN service brand. NTT DOCOMO officially confirmed SOLiD's participation on September 27 while unveiling the new lineup of OREX services at MWC Las Vegas. OREX is DOCOMO's Open RAN service brand, developed in collaboration with multiple global vendors.

"The O-RAN market is poised for significant growth, attracting the interest of communication equipment companies," said Dae-Young Kim, Ph.D., Executive Vice President, SOLiD. "SOLiD achieved over 17 billion KRW in O-RAN-related sales last year, and it's among the few companies where the O-RAN business is translating into actual revenue."

In fact, the global O-RAN market is projected to witness substantial growth, with an estimated compound annual growth rate (CAGR) of 36.9%, increasing from $1.3 billion in 2022 to $8.9 billion in 2028, according to market research and consulting firm KSI.

SOLiD has recently demonstrated remarkable achievements in the O-RAN sector, including a series of successful demonstrations at the global O-RAN proof-of-concept event organized by the international O-RAN ALLIANCE standardization organization.

The open wireless network O-RAN technology disaggregates the hardware and software of wireless communication equipment, such as base stations, enabling interoperability between base station equipment from various manufacturers. This provides telecommunications companies advantages in expanded equipment options, reducing dependency on a single equipment provider, and lowering infrastructure deployment costs. Due to these benefits, both equipment companies and mobile network operators (MNOs) are working to advance O-RAN technology.

Leveraging its established O-RAN technology expertise both domestically and internationally, SOLiD has accomplished various milestones. In addition to becoming a partner in NTT DOCOMO's OREX, SOLiD has entered into a partnership with ASOCS, a leading provider of private 5G network software solutions, to offer O-RAN-compatible solutions. Moreover, SOLiD was exclusively selected for the mobile communication service modernization project at Signal Iduna Park, the home stadium of Borussia Dortmund in the German Bundesliga, and is actively setting up a network in an O-RAN environment in collaboration with German Telecommunication Company 1&1 Drillisch.

"SOLiD’s selection as an OREX supplier to NTT DOCOMO is a logical progression following the recent global O-RAN Plugfest," said Dae-Young Kim, Ph.D., Executive Vice President, SOLiD. "We are determined to maintain our strong market leadership position in the O-RAN market, which is expected to experience substantial growth in the future."

Mapping the Evolution to Multi-Operator Networks

Mobile networks are constantly evolving, and advancements in neutral host distributed antenna system (DAS) technology are keeping pace, enabling more efficient, scalable, and reliable connectivity. As a result, wireless in-building service quality is generally much improved over what it was in the early days of DAS, even as demand for mobile data skyrockets. And yet, to properly receive the latest wireless signal sources from multiple operators, in-building DAS systems must continue evolving to match mobile network operator (MNO) infrastructure transformations.

Mobile networks are constantly evolving, and advancements in neutral host distributed antenna system (DAS) technology are keeping pace, enabling more efficient, scalable, and reliable connectivity. As a result, wireless in-building service quality is generally much improved over what it was in the early days of DAS, even as demand for mobile data skyrockets. And yet, to properly receive the latest wireless signal sources from multiple operators, in-building DAS systems must continue evolving to match mobile network operator (MNO) infrastructure transformations.

The growing adoption of 5G technology is driving the need for further changes in the mobile network, including greater cell site densification. However, more than 450,000 outdoor small cell nodes were already operating across the U.S. by the end of 2022, making new site build-out increasingly difficult. This challenging situation requires new approaches to network deployment and management.

Transformation Ahead

Today, in-building coverage is commonly provided by traditional neutral host DAS infrastructure shared by multiple operators. This familiar in-building coverage model has been used for many years and is universally accepted and proven. Although MNOs share the DAS equipment, they have their own radio access network (RAN) infrastructure, providing full visibility and control of the radio access network.

As MNOs face ever greater economic pressures and coverage mandates worldwide, the need to further drive down costs is inevitable even as they strive to densify coverage. Active RAN sharing helps MNOs reduce costs and avoid potential performance and maintenance problems caused by over-building their networks. This shared infrastructure approach to network deployment provides several benefits, from improved cost efficiencies to reduced environmental impacts.

When transitioning to an active shared RAN model in the future, MNOs will have various neutral host network configuration possibilities as follows, ranging from minimum to maximum sharing:

MORAN

With a multi-operator RAN (MORAN), multiple MNOs share radios, antennas, towers, and power, but each has dedicated baseband units (BBUs). A ‘shared O-RU’ feature, which the O-RAN Alliance working group four is standardizing, is a cost-effective option in O-RAN networks. This configuration allows full visibility and control of BBU equipment but requires changes to fronthaul switches to enable multiple interfaces. A shared, multi-operator RAN deployment can be used with licensed spectrum for a public network or with Citizens Broadband Radio Service (CBRS) spectrum for private networks - either over general authorized access (GAA) channels or using priority access license (PAL) channels for dedicated bandwidth.

MORAN + BBU Sharing

The amount of RAN sharing increases marginally with MORAN + BBU sharing. This co-location model involves multiple operators sharing all RAN equipment while each MNO still uses its dedicated spectrum. This configuration helps reduce BBU and fronthaul costs but still limits the visibility of the RAN network.

MOCN

Finally, with the multi-operator core network (MOCN) architecture, multiple MNOs share one or more CBRS channels to achieve maximum RAN sharing and cost efficiency. A key difference between MOCN and MORAN is the sharing of spectrum, allowing MNOs to pool spectrum allocations for greater resource efficiency. Although the lead operator in this deployment may have access to some dedicated spectrum channels and RAN control, this scenario affords limited visibility of the RAN for all other operators and GAA spectrum dependency.

DAS Evolution

As future mobile networks evolve to progressively greater architecture sharing, cost and efficiency benefits will increase, even as operator flexibility and control decrease. Likewise, these macro network changes will also impact how in-building DAS equipment operates, requiring DAS architecture to evolve as well. Future DAS architecture will share the distribution and intermediate layers between the DAS headend and the MNO networks.

When considering the difference in shared spectrum between DAS/MORAN and MOCN, MOCN will be an efficient solution for small venues or enterprise networks where coverage is more critical than capacity. We could also expect further enhancements from a neutral host DAS standpoint when converged with MORAN.

Currently, most neutral host DAS platforms use separate RANs for each MNO, but greater efficiency is possible if the RAN portion becomes MORAN. Fundamentally, RAN provides capacity, and neutral host DAS distributes capacity from multiple MNOs to multiple antenna points. In a case of extreme capacity sharing, neutral host DAS becomes more cost-efficient than MORAN because MORAN radios with a function of (Low) PHY will be more expensive than DAS radios. In fact, neutral host DAS with an O-RAN (eCPRI) interface to MORAN with BBU sharing could be the most efficient in-building solution.

A Solid Future

With the inevitable evolution of mobile networks, a RAN sharing model may eventually offer greater cost-efficiency when providing in-building coverage for small and medium-sized venues. This transformation won’t happen overnight, but when it does, SOLiD’s neutral host DAS will evolve to keep pace. In fact, SOLiD already offers Open RAN architectures to support private networks over CBRS. These next-generation architectures provide a logical stepping stone to future DAS components that work with RAN sharing.

SOLiD is leading this progression at the forefront of in-building technology advancements to ensure that DAS systems continue evolving in lock step with MNO infrastructure. Trust SOLiD to deliver the latest technologies for always-on, everywhere, in-building connectivity and interoperability testing for both public and private networks. To learn more, visit https://solid.com/us/open-ran/

SOLiD and ASOCS Unveil Joint O-RAN Solution for Private 5G Networks

Scalable, CBRS-compliant, Open RAN solution unleashes private 5G and industrial IoT for Industry 4.0 transformation

SOLiD, the leader in cellular in-building mobile coverage, and ASOCS, a leading provider of private 5G network software, today announced a partnership to deliver a complete O-RAN-compliant solution for private 5G and Industrial IoT (IIoT) networks. The joint solution enables rapid deployment of scalable private 5G campus networks with intelligent real-time positioning using the Citizens Broadband Radio Service (CBRS) spectrum.

The new private 5G network solution comprises the SOLiD CBRS O-RAN Radio Unit (O-RU), the ASOCS CYRUS® virtual O-RAN Distributed Unit (O-DU) and Centralized Unit (O-CU), and ASOCS Hermes NGP real-time positioning software. The CBRS-compliant solution, certified by the OnGo Alliance, empowers a range of mission-critical Industry 4.0 use cases, such as manufacturing automation, predictive maintenance, real-time asset tracking, and occupational health and safety.

The SOLiD CBRS O-RU complies with O-RAN ALLIANCE fronthaul specifications, supporting 4G LTE and 5G New Radio (NR) in standalone (SA) or non-standalone (NSA) architecture. The O-RU is compatible with various virtual or physical baseband products via an eCPRI interface. To improve private 5G network service agility, scalability, and efficiency, the SOLiD Fronthaul Multiplexer (MUX) technology eliminates the need for dedicated bandwidth for each RU, enabling more economical use of the CBRS spectrum.

“With the power of AI, the ASOCS software-as-a-service solution enables a cloud-based private 5G network with real-time indoor/ outdoor positioning intelligence to connect data-driven Industry 4.0 edge applications with high accuracy and low latency,” said Niv Zimmerman, vice president of solutions, ASOCS. “Together with SOLiD, we offer a unique, comprehensive solution for deploying private 5G and IIoT networks in a scalable model.”

“SOLiD is at the forefront of innovating connectivity with Open RAN architecture, changing how mobile network operators, system integrators, and manufacturers build tomorrow’s networks,” said Yong Hoon Kang, Ph.D., chief technology officer, SOLiD Americas. “The powerful combination of the SOLiD CBRS O-RAN Radio Unit and ASOCS software unleashes 5G to enable fast, turnkey deployment of robust and secure private in-building networks that transform the business environment.”

“With low latency, fast data speeds, high reliability, and solid security, the true promise of 5G over CBRS is to enable Industry 4.0 applications for greater productivity and profitability,” said Alan Ewing, executive director, OnGo Alliance. “The SOLiD and ASOCS collaboration is an outstanding example from two of our members of how 5G NR and CBRS come together to deliver exceptional performance.”

SOLiD and ASOCS have completed multiple interoperability tests proving the performance of their Open RAN technologies. To learn more, visit SOLiD and ASOCS in meeting room #1178 at MWC Las Vegas, September 26-28.

How New 5G Radios Impact In-Building Connectivity

Mobile 5G technology promises to deliver many innovative new services and capabilities, including higher mobile capacity, faster data speeds, and ultra-reliable low-latency connectivity. These advancements are made possible by fundamental changes in the communications network architecture. However, these evolutionary transformations also can affect how 5G networks perform in conjunction with in-building Distributed Antenna System (DAS) systems.

So, what do you need to know about 5G networks to ensure your building tenants, employees, and visitors continue to experience seamless, always-on mobile connectivity?

Introducing 5G NR

As mobile networks evolve from 4G to 5G, significant architectural changes transform how these next-generation networks operate. A key aspect of this transformation is an improved wireless air interface called 5G New Radio (NR), which enables high-capacity throughput delivery. This technology allows the 5G radio access network (RAN) to use radio frequency (RF) spectrum more efficiently for significantly faster and more responsive mobile experiences than legacy 4G LTE networks.

The newest spectrum released for use with 5G NR uses Time Division Duplexing (TDD) — a method of separating uplink (UL) and downlink (DL) transmissions. The TDD method enables UL and DL functions to occur on the same frequency, unlike Frequency Division Duplexing (FDD), which requires two separate RF frequencies to send and receive data. TDD allows the 5G NR to accommodate large blocks of contiguous spectrum, supporting larger channel widths to provide greater capacity and flexibility.

However, the new 5G spectrum exists at higher frequencies with shorter signal propagation, limiting coverage, particularly indoors. To take full advantage of the potential that 5G offers, network managers need to optimize in-building DAS deployments, which may require the replacement of existing antennas and coaxial splitters to ensure high quality for maximum service availability.

Maximize 5G In-Building Connectivity

When deploying and configuring a DAS system today, it’s critical that you consider all the available 5G frequencies used in adjacent macrocell networks and recognize how each frequency band will impact your in-building DAS deployment. To better understand 5G NR technology and the new frequencies that 5G networks use, download the technical brief How to Make the Most of 5G for Improved In-Building Connectivity