How to Maximize In-Building 5G Coverage and Capacity

Tomorrow’s business will run on 5G networks, with new opportunities enabled by private enterprise networks, IoT connectivity, and faster mobile data speeds. An estimated 725 million 5G devices will be sold worldwide this year. As communications service providers (CSPs) increase the rollout of 5G services, seamless coverage everywhere is an absolute necessity, including indoors. Unfortunately, modern building materials block or degrade cellular signals, particularly at higher frequencies. When your building’s tenants or employees frequently experience weak signals or dropped calls, the results are detrimental to your business.

The key to a seamless 5G experience throughout your building is to maximize network capacity and coverage. And one of the most efficient and effective ways to accomplish that is with an indoor distributed antenna system (DAS) that enables carrier aggregation. The process of carrier aggregation (CA) combines multiple frequency blocks (called component carriers) to support wider transmission bandwidths, increasing the peak data rate per user, maximizing spectrum efficiency, and boosting the overall network capacity and throughput.

Aggregating component carriers means that 5G devices use multiple frequency bands. Essentially, CA technology is like having a wider pipe to accommodate more traffic flowing through it. As a result, mobile network subscribers working or living in the building enjoy faster download and upload speeds, less video buffering, and fewer dropped calls.

Optimize 5G Carrier Aggregation

While 4G/ LTE networks support CA, 5G provides even more bandwidth per user. 5G CA supports even more component carriers, plus dual connectivity that allows user devices to transmit and receive data across multiple frequency bands simultaneously. However, not all in-building wireless solutions provide the bandwidth to take advantage of the latest 5G advancements.

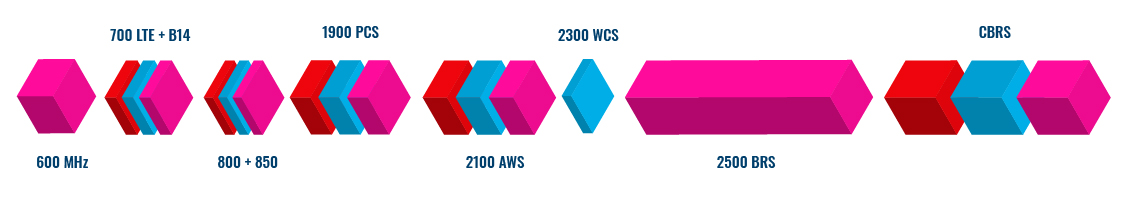

As the leader in multi-carrier DAS solutions, SOLiD offers the broadest available support for carrier aggregation, aggregating more bandwidth across more frequency bands in a more versatile solution. The SOLiD ALLIANCE 5G DAS platform offers the capability to aggregate across up to eight bands over a single fiber, supporting the 5G frequency bands currently used by the top CSPs in the U.S. — even when each CSP aggregates spectrum from a different combination of bands.

Pay-As-You-Grow Capacity

Unlike bandwidth-constrained competitive infrastructure, the scalable SOLiD ALLIANCE solution offers the flexibility of a pay-as-you-grow solution. Fiber2Coax modular solutions scale from one to seven bands, and Fiber2Antenna solutions expand from four to eight cellular frequency bands with an easy-to-install add-on remote unit. These flexible solutions use a universal head-end and may be deployed in a mixed-use fashion to match the unique features of your building. SOLiD ALLIANCE scalability protects your investment, allowing support for new bands as the Federal Communications Commission (FCC) releases new 5G spectrum allocations up to 4 GHz.

SOLiD enables maximum 5G carrier aggregation to deliver more bandwidth and throughput with familiar DAS in-building wireless infrastructure, delivering the best mobile user experience. SOLiD achieves this because the ALLIANCE 5G DAS solution inherently supports multiple operators in multiple bands and delivers the full bandwidth in every cellular band.

Highest Bandwidth at the Lowest Cost

Reliable in-building connectivity is critical. Yet even as 5G adoption continues to accelerate, CSPs are challenged to build out network coverage that is sufficiently dense and powerful to penetrate most buildings and venues. The SOLiD ALLIANCE 5G DAS platform efficiently delivers dedicated, reliable cellular coverage with multi-operator support in any building, campus, stadium, or airport. A modular remote system allows easy capacity upgrades and changes in frequency bands to adapt to new spectrum allocations. Keep pace with new technology advancements without expensive and time-consuming rip and replace scenarios with the ALLIANCE 5G DAS platform for faster speeds, more capacity, and unmatched signal strength. To learn more about how to protect and optimize your in-building connectivity investment, click here.

Understanding Cellular Bandwidth and Why It Matters

As of January of this year, 4.66 billion people—more than half of the world’s population—were actively using the internet. Of this number, a whopping 92.6% access the internet using mobile devices. With such a vast number of people accessing massive data, today’s service providers are in need of network upgrades to increase bandwidth capacity.

Cellular Bandwidth in Layman’s Terms

Many consumers mistakenly think of cellular bandwidth as internet speed; but of course, these two are entirely different. A common metaphor used to make the distinction clear is to visualize water flowing through a pipe. Internet speed is how quickly a drop of water (data) flows through the pipe, while bandwidth capacity is the diameter of the pipe, and bandwidth is the total amount of water that flows through the pipe in a certain amount of time. So the larger the pipe, the more water can flow through it, and the faster its potential flow rate.

With the increasingly digital and mobile economy, people are consuming more and more cellular bandwidth, compelling service providers to increase their bandwidth capacity to meet subscriber demand. Over the years, bandwidths have increased from mere kHz to MHz, and speeds from Kbps to Mbps. 5G holds the promise of delivering data at Gigabit speeds, allowing subscribers to receive the maximum amount of data possible in the shortest amount of time.

How Is Cellular Bandwidth Consumed?

Every time consumers connect to the internet, they consume bandwidth. The more bandwidth a data connection has, the more data it can send and receive simultaneously. The more bandwidth a provider delivers, the faster consumers can transmit and receive data. However, the amount of bandwidth and data they can use monthly depends on their network plan with their service provider.

For instance, a consumer subscribed to a 10 Mbps plan could download 10 MB of data per second. If several users share the same connection, each can only download a portion of the limit, resulting in much slower download times.

When we apply these principles to a cell site we can see that the amount of spectrum deployed at the cell site (capacity) and the technologies in use, such as 3G, 4G, and 5G (flow rate), determine the capacity available to consumers. If four or more connected devices all use cellular data, 10 Mbps is not enough to provide the speed and amount of data needed for seamless connectivity. The more users sharing the capacity, the worse the experience is for all of them.

How Much Cellular Bandwidth Do Consumers Need?

According to a January 2021 Statista report, video apps accounted for 66.2% of global mobile data usage every month. Meanwhile, social networking accounted for around 10.1% of global mobile data volume. Streaming a video in standard definition already requires 3 to 4 Mbps. In HD, it would require about 5 to 8 Mbps. Add to that all the other connected devices in a home, and a family of four would need much more than 25 Mbps.

The FCC provides a Broadband Speed Guide to give consumers an idea of the minimum download speed required for the adequate performance of various online activities. General browsing, checking emails, social media browsing, standard video conferencing, VoIP calls and streaming online radio require around 1 Mbps. Virtual classes, online learning platforms, telecommuting, downloading files and video teleconferencing would need anywhere from 5 to 25 Mbps.

Based on these data, an average American family would need to subscribe to a 25 Mbps plan to do basic activities like surfing, videoconferencing, and music streaming. But to enjoy streaming HD videos, playing multiplayer online games, and downloading large files, they would need plans with 100 Mbps and above.

The challenge facing service providers now is how to efficiently increase their capacity to provide the massive bandwidth that their customers require.

Where Do Users Consume a Lot of Cellular Bandwidth?

To enhance their services, providers must also determine where consumers use the bulk of bandwidth. This will enable them to identify in which areas to increase their capacity.

Indoors, consumers typically use Wi-Fi to connect devices to wireless routers. These routers connect to modems with fiber or broadband connections. However, Wi-Fi has a limited range, so consumers tend to use cellular data outdoors or in places with weak Wi-Fi.

In public places where Wi-Fi connections are not secure, most consumers also prefer using their cellular data. They either use portable Wi-Fi devices or turn their smartphones into mobile hotspots. Either way, this consumes cellular bandwidth as well. Because of security issues in public places, higher cellular traffic occurs in cafés, convention halls, hotels, sports arenas and similar venues.

What Devices Do Consumers Typically Use?

Smartphones are still the most popular devices for accessing the internet. According to Pew Research, 85% of Americans own a smartphone, while only 77% own desktops and laptops, and a mere 53% have tablets. However, many consumers today own more than one of these devices and use them concurrently.

New technologies also lead to increased use of smart monitors, digital devices with IoT applications, and products with machine-to-machine communication capabilities. In the coming years, most of the devices people use at home and work will connect to the internet, further reinforcing the need for higher bandwidth capacity and faster network speeds.

Meeting Bandwidth Demands with 5G mmWave

Over the years, there has been a steady increase in the number of internet users. The most recent Pew Research survey indicates that 93% of US adults actively use the internet. As full digitization continues to be implemented across all industries, we can expect this number to grow faster in the next couple of years.

Aside from this, IoT applications are also becoming a ubiquitous part of our lives, thanks to the convenience of ‘smart’ devices. We can now connect the objects we use every day to the internet, enabling seamless communication between people and things. Today, industrial machines, cars, kitchen appliances, office equipment, and many other connected devices can interact digitally.

As the number of devices we use that require access to cellular networks increases, service providers must find ways to meet our increasing bandwidth demands. Some of these providers have already started rolling out their 5G services to do so.

Major network operators now offer sub-6 GHz 5G, which is faster than 4G. However, to meet the demands of consumers for more data and faster connectivity, in areas with very dense capacity demands, mmWave spectrum is deployed to provide many hundreds of MHz of additional bandwidth. However, mmWave is not economical for wide-area deployment because mmWave frequencies do not propagate over long distances and are blocked by most objects and materials, including energy-efficient glass.

To fully maximize the benefits of 5G, service providers must understand how and where consumers use data. 5G deployments use low, mid, and high-band spectrum to balance capacity demands with network costs. The C-Band spectrum – or so-called mid-band – provides a good compromise between large channel bandwidth capability and reasonable propagation characteristics. T-Mobile uses the 2500 MHz band for this purpose, while Verizon and AT&T purchased large portions of the C-Band in recent auctions.

To enable indoor and outdoor cellular communications, including at many of the world’s best-known and most challenging venues, SOLiD modular solutions scale to every challenge. The SOLiD ALLIANCE 5G DAS provides full band coverage for both 2500 MHz and C-Band. The edgeROU Fiber2Antenna DAS provides up to eight commercial cellular and private networking frequency bands over a single fiber strand to a lightweight, low-power, aesthetically pleasing DAS remote with high-performance integrated antennas. Contact us to discuss your specific DAS needs to meet capacity requirements, today and tomorrow.

The Global State of the O-RAN Market in 2021

As mobile network operators (MNOs) face increasing operating costs and competitive pressures, they are increasingly veering away from legacy proprietary networks. Instead, they are moving towards open and virtualized architectures in an effort to increase flexibility, reduce costs and break away from vendor lock-in, allowing them to achieve operational gains and boost return on investment (ROI). The introduction of 5G is the ideal opportunity to accelerate this transition.

Since the evolution to 5G requires MNOs to replace or enhance radio access network (RAN) equipment, we are now seeing more operators worldwide adopting Open RAN (O-RAN) architectures. In addition to facilitating the switch to 5G, infrastructure compliant with O-RAN standards enables MNOs to enhance network flexibility, lower deployment costs and improve innovation cycles. As a result, although the O-RAN market is in its nascent stage, it is projected to be worth more than $3 billion by 2024.

The Road to O-RAN

Because traditional RAN architecture uses proprietary equipment and vendor-defined interfaces, even the slightest changes to a wireless network are costly, labor-intensive and time-consuming for MNOs. Proprietary interfaces have traditionally prevented network operators from competitively shopping for equipment, locking them in to a single network equipment vendor. By adopting O-RAN standards-based interfaces, MNOs have more flexibility to choose equipment from multiple vendors, helping to reduce costs and fuel innovation through competition.

Open RAN is not new. For decades, MNOs have been exploring the idea of an open, standards-based interface. However, technical and integration challenges prevented them from taking it further. Yet, over the past year, significant strides have been made. Suppliers are increasing investments in the field, while operators are committing to experimentation and trials. Moreover, some countries are implementing policy measures supporting O-RAN to reduce reliance on foreign vendors.

As of now, there might be only 35 active O-RAN deployments around the globe, according to Deloitte. Many of these involve testing in rural, greenfield and emerging markets. However, this figure can easily double within the year and continue to accelerate. In fact, Deloitte projects that O-RAN could represent 10% of the RAN market by 2025.

Plus, the growth rate of O-RAN could potentially be higher—that is, if government policies require MNOs to replace existing equipment from restricted vendors.

What Is Fueling O-RAN Growth?

Several factors are actively pushing O-RAN closer to reality, from increasing capital costs and favorable government policies, to technological advancements like 5G and cloud virtualization. Here are the most compelling value propositions of Open RAN architectures.

Low upfront costs

Virtual RAN architectures have the potential to lower upfront deployment expenses and operating costs. These reductions are very compelling during this time of peak demand for 5G wireless.

Each time the mobile network generation transitions, such as 4G to 5G and eventually 5G to 6G, additional frequency bands are also made available. Presently, many MNOs are using higher frequency bands to deploy 5G, requiring greater cell density due to lower propagation distances. Therefore, the networks require many more cell sites to achieve the expected coverage, capacity and data speeds. In the US alone, to deploy 5G will require about 2 million new cell sites and upgrades at all existing sites. Additionally, in-building wireless upgrades must also occur to ensure seamless coverage.

Open RAN architecture can help operators minimize capital costs by aggregating baseband functionality through a single baseband unit (BBU) with multi-radio compatibility. Aside from lowering hardware costs, O-RAN architectures also are more adaptable and flexible to the ever-changing landscape of technology. Instead of replacing entire physical systems to cater to new market conditions, they can introduce new features and functionalities using software, reducing downtime for maintenance as well as increasing scalability.

Fast innovation cycles

Software-driven RAN enables smart automation, which changes the way operators manage their networks. It can eliminate the manual work involved in maintaining and optimizing the networks, leading to faster innovation cycles.

By unlocking a new level of interoperability, vendors can come up with products and solutions that cater to multiple operators. They can also focus on their specializations instead of having to create an end-to-end system.

Furthermore, O-RAN systems provide operators with deep insights into their network, allowing them to create solutions to optimize their network.

Vendor diversity

For years, the Multiple Input Multiple Output (MIMO) RAN vendor market has been dominated by five main players: Huawei, Ericsson, Nokia, Samsung and ZTE. They control up to 95% of the RAN market. Its top three players—Huawei, Ericsson, and Nokia—make up about 80% of the market.

In the US, federal funds can no longer be used on communications equipment or services from untrusted vendors, particularly ones that may pose a national security risk. Two of the largest RAN vendors in the world—Huawei and ZTE—fall into this category.

Other countries are following this move. The United Kingdom, for instance, has not only banned new purchases but has also authorized the removal of unrestricted kits from their networks. Japan, New Zealand, and Australia are also banning untrusted vendors from their 5G networks. Likewise, European operators want authorities to create local Open RAN supply chains so that they are not limited to Asian and US vendors. Such developments can lead to a more diverse and competitive global market.

What Are the Barriers to O-RAN Adoption?

O-RAN might sound like a promising solution for existing network challenges. However, it comes with many challenges and barriers as well. One of the main concerns involving O-RAN adoption is system integration.

In a traditional architecture, vendors are responsible for implementation and upgrades. If operators veer away from this setup, they need system integrators to ensure interoperability and performance of the network. The challenge is that since O-RAN is still in its initial stages, not many system integrators are well-versed and experienced in its architecture.

Moreover, Open RAN experiments are mostly limited to local and regional developments at this stage. The complexity of the architecture’s integration is manageable at a smaller scale, but it is still unclear if O-RAN will be truly scalable to larger networks, particularly with heavier traffic and higher performance requirements.

How Is O-Ran Adoption Varying by Region?

Due to the ban on Chinese tech giants in the US and a few European countries, Asia, Africa, and South America are prospective markets for Chinese equipment. According to Dell’Oro Group, the Asia-Pacific region is driving the growth of the market. One factor behind its surge is the shift from proprietary RAN to Open RAN in Japan. Although macro developments are dominating the O-RAN revenue mix on the global scale, the rise of millimeter-wave deployments in Japan is fueling the growth of small cell activity.

In India, two of the top three major operators are developing O-RAN network technology. They are working alongside equipment manufacturers and system integrators from the US and Japan. With a billion mobile users, this underdeveloped market’s O-RAN technology might prompt faster and less costly deployment of 5G.

A number of large telecom operators in Europe – Deutsche Telekom, Orange, Telefonica, TIM and Vodafone — are hard at work to advance adoption of O-RAN. They announced that they will seek funding from European governments to develop and deploy O-RAN technologies, and they have signed a memorandum of understanding promising to support O-RAN technologies and urge further investments.

Germany has already established a $2 billion program to support O-RAN solutions, which welcomes other European operators to join its alliance. The United Kingdom has its own $350 million initiative as well, which is aimed at developing O-RAN systems and equipment.

The State of the O-RAN Market in the US

Interest in O-RAN architecture is building up in the US, and all three major mobile operators in the country are part of the O-RAN Alliance, as well as the Open RAN Policy Coalition.

The O-RAN Alliance, which was launched in 2018 by Deutsche Telekom, NTT DoCoMo, AT&T, Orange and China Mobile, is working to further a common interest: a more Open RAN. In the past few years, this alliance has grown significantly, and now has 237 telecom equipment operators and manufacturers, many of which are based in the US.

Earlier this year, the US Department of Defense announced that they are looking into different ways to speed up the development of open 5G systems in order to enhance the DoD’s ability to achieve its missions, as well as veer away from equipment from Huawei, as well as other Chinese vendors. Tech giants also are urging the US government to implement O-RAN testing and certification facilities to help accelerate innovation. In a statement to the Federal Communications Commission (FCC), Intel expressed the importance of financial incentives and other program-based funding. These can benefit companies within the O-RAN ecosystem, such as those in the RAN hardware and virtualized software market.

Takeaway

Open RAN is still in its early stages, but it is evident that there is growing global interest in the technology. O-RAN’s potential to lower costs, promote vendor diversity and drive innovation cycles is pushing operators to move away from closed, proprietary systems and embrace open architectures.

Companies from all corners of the telecom industry are banding together to support Open RAN, ranging from traditional RAN equipment vendors to new O-RAN innovators. Network hardware, software and component vendors, chipset vendors, and cloud service providers are also crucial to this growing ecosystem.

There are, however, a few challenges that are hindering the growth of O-RAN. For starters, its ability to accommodate larger networks with large volumes of traffic and high-performance requirements has yet to be proven. On top of that, multivendor system integration, which possibly entails significant time, money, and effort for validating equipment vendors, might offset all the advantages of vendor diversity.

For this reason, O-RAN developments are mostly concentrated on local and regional deployments. Small-scale deployments make it easier for MNOs to handle the integration complexity. However, as O-RAN technology matures, the global market is bound to see rapid and widespread adoption.

As a member of the O-RAN ALLIANCE, SOLiD is dedicated to development of the Open RAN ecosystem for the advancement of open, interoperable interfaces and RAN virtualization. The SOLiD SURF™ platform of O-RAN compliant radio solutions allows operators to diversify their ecosystem and speed the delivery of commercial 5G services in an all-in-one configuration compliant with open, multi-vendor specifications. For more information, visit: https://solid.com/us/solid-reveals-surf-platform-for-o-ran-compliant-ran-solutions/.

ioXt Alliance Certifies SOLiD DAS Controller

Certification by ioXT Alliance advances security for cellular in-building mobile coverage

NEWPORT BEACH, CALIF. – September 30, 2021 -- The ioXt Alliance, the global standard for IoT security, today announced that SOLiD’s Distributed Antenna System (DAS) DMS-1200 Controller has been certified through the ioXt Certification Program. The certification was given after SOLiD met rigorous standards as part of the ioXt Alliance’s program, advancing efforts to improve the security of IoT and other connected devices running on one of the world’s most popular operating systems. SOLiD’s DAS controller, which provides indoor solutions for improved cellular coverage and capacity, went through multi-step testing in a certified-lab to earn this certification.

“We’re dedicated to providing excellent experiences for in-building mobile users, and security plays a core, critical role in creating greater confidence among our customers and partners,” said Slavko Djukic, Vice President Product Line Management & Technology, Americas, of SOLiD. “This industry-backed certification by ioXt Alliance validates our commitment to security and keeping consumers safe.”

“SOLiD’s proactive step in certifying its DAS controller to meet our industry-led standards, raises the bar for security and privacy commitments in the industry,” said Rebecca Onaitis, Director, IoT, of the ioXt Alliance. “SOLiD’s products and services are built with security from the beginning, giving customers -- arenas, airports, corporate buildings and more -- some added peace of mind.”

Founded on eight core pledge principles that define product security, product upgradability and consumer transparency, the ioXt Alliance harmonizes global security regulations to provide clear guidelines for quantifying the optimal level of security needed for a specific device within a certain location and product category. Once a device meets or exceeds the requirements after testing, it receives the ioXt SmartCert label.

The SOLiD DAS DMS-1200 Controller provides an enterprise level interface between the fiber optic DAS and Network Operations Center (NOC). The DMS-1200 gathers vital system information and data from the DAS networks to communicate, and through this certification, it has been verified that the information is protected.

To learn more about the ioXt Alliance and how to get involved, follow them on LinkedIn or visit www.ioxtalliance.org. To learn more about SOLiD DAS DMS-1200 Controller, visit https://compliance.ioxtalliance.org/product/330.

SOLiD announces its selection by BAI Communications to provide DAS Solutions in London’s Underground

“A City For All Londoners” prioritizes seamless connectivity in London’s largest “not spot.”

READING, UK — August 18, 2021 — SOLiD, the leader in cellular in-building mobile coverage, announces its selection by BAI Communications (BAI), a leading neutral host provider, to use its GENESIS Distributed Antenna System (DAS) as part of the project to deliver high-speed mobile connectivity across the London Underground. This selection of SOLiD by BAI facilitates London Mayor Sadiq Kahn’s vision of world-class connectivity across the city.

Transport for London (TfL) is a local government agency that manages London’s public transport network. Its Telecommunications Commercialisation Project (TCP) will provide cellular connectivity in the Underground’s tunnels and stations where service has been non-existent. TfL established Wi-Fi in 270 stations and now targets full mobile access in its 400 km of tunnels and within all stations and platforms that are underground.

BAI’s partnership with TfL will establish a long-awaited connectivity backbone with a city-wide integrated communications network delivering multi-carrier cellular, Wi-Fi, and fibre connectivity services. Building on the success of previous project collaboration work, such as the New York City subway, BAI will deploy in the London Underground SOLiD’s groundbreaking GENESIS DAS that provides seamless cellular communications in hard-to-serve areas. To meet the project’s challenging environmental, space, and reliability requirements, SOLiD will provide project-fit customization of the GENESIS DAS solution.

TfL’s earlier pilot for 4G coverage, which began in March 2020 and covered most of the tunnels and stations between Westminster and Canning Town along the Jubilee line, used SOLiD’s GENESIS DAS solution. Customers’ phones automatically search for the mobile signals emitted by the DAS, achieving continuous connectivity as if above ground.